Top Guidelines Of Personal Loans Canada

The Of Personal Loans Canada

Table of Contents8 Easy Facts About Personal Loans Canada DescribedNot known Incorrect Statements About Personal Loans Canada The Only Guide for Personal Loans CanadaSome Ideas on Personal Loans Canada You Need To KnowThe smart Trick of Personal Loans Canada That Nobody is Discussing

Doing a normal budget plan will certainly offer you the confidence you require to manage your cash effectively. Good points come to those that wait.But conserving up for the big points suggests you're not entering into debt for them. And you aren't paying extra in the future because of all that passion. Trust fund us, you'll delight in that family members cruise or play area collection for the youngsters way more knowing it's currently paid for (instead of making settlements on them up until they're off to university).

Nothing beats satisfaction (without financial obligation obviously)! Debt is a trickster. It reels you in just to hold on for dear life like a crusty old barnacle. But you don't have to turn to personal loans and financial obligation when things get tight. There's a better way! You can be devoid of financial obligation and begin materializing traction with your money.

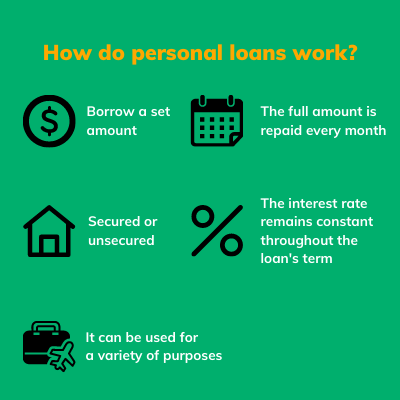

An individual funding is not a line of credit history, as in, it is not revolving funding. When you're accepted for a personal car loan, your lender offers you the full amount all at as soon as and then, generally, within a month, you begin settlement.

The Best Strategy To Use For Personal Loans Canada

Some banks put terms on what you can utilize the funds for, however lots of do not (they'll still ask on the application).

The demand for personal loans is climbing among Canadians interested in getting away the cycle of payday car loans, consolidating their financial debt, and restoring their debt rating. If you're applying for an individual financing, right here are some things you should keep in mind.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

The 7-Minute Rule for Personal Loans Canada

Additionally, you may be able to reduce just how much overall passion you pay, which indicates more cash can be saved. Individual fundings are he has a good point powerful tools for developing your credit rating. Payment history make up 35% of your credit history, so the longer you make normal repayments promptly the a lot more you will see your rating increase.

Individual car loans supply an excellent opportunity for you to reconstruct your credit and settle financial debt, yet if you do not budget plan appropriately, you might dig on your own right into an even much deeper hole. Missing out on among your monthly repayments can have a negative effect on your Look At This credit history however missing out on several can be ravaging.

Be prepared to make each and every single settlement on schedule. It holds true that an individual lending can be utilized for anything and it's easier to obtain accepted than it ever was in the past. If you do not have an immediate demand the extra cash, it may not be the best option for you.

The dealt with monthly payment amount on a personal financing relies on just how much you're borrowing, the rate of interest, and the set term. Personal Loans Canada. Your rates of interest will depend on elements like your credit rating and revenue. Many times, personal funding rates are a great deal less than charge card, yet occasionally they can be greater

Facts About Personal Loans Canada Uncovered

The market is great for online-only lending institutions lending institutions in Canada. Benefits consist of wonderful rate of interest prices, exceptionally quick handling and funding times & the privacy you may want. Not everyone suches as walking right into a bank to request for money, so if this is a challenging area for you, or you just don't have time, Get More Information looking at on the internet lenders like Spring is an excellent choice.

Repayment lengths for personal finances usually fall within 9, 12, 24, 36, 48, or 60 months (Personal Loans Canada). Shorter payment times have extremely high monthly repayments however then it's over swiftly and you do not shed more cash to interest.

Some Known Incorrect Statements About Personal Loans Canada

You may get a lower interest rate if you fund the car loan over a much shorter period. A personal term car loan comes with an agreed upon repayment timetable and a taken care of or floating interest price.